What to Do If You're Upside Down on Your Home in Aubrey, TX: Options to Avoid Foreclosure

In today’s changing real estate market, many homeowners in Aubrey, TX find themselves in a tough spot: owing more on their mortgage than their home is worth. If you’re "upside down" on your home, don’t panic—you have options, and foreclosure is not your only route.

Here’s what you need to know, and how you can take back control of your situation.

1. Loan Modification

If you’re struggling to keep up with payments, your lender may offer a loan modification. This option changes the terms of your existing mortgage—often lowering the interest rate or extending the loan period—to reduce monthly payments.

Aubrey homeowners may benefit from local lenders who are increasingly open to modification to avoid adding more inventory in a high-interest market.

2. Short Sale

A short sale occurs when your lender agrees to let you sell the home for less than you owe. While this still affects your credit, it’s much less damaging than a foreclosure. Many homeowners in Denton County have successfully negotiated short sales—especially if you can show financial hardship.

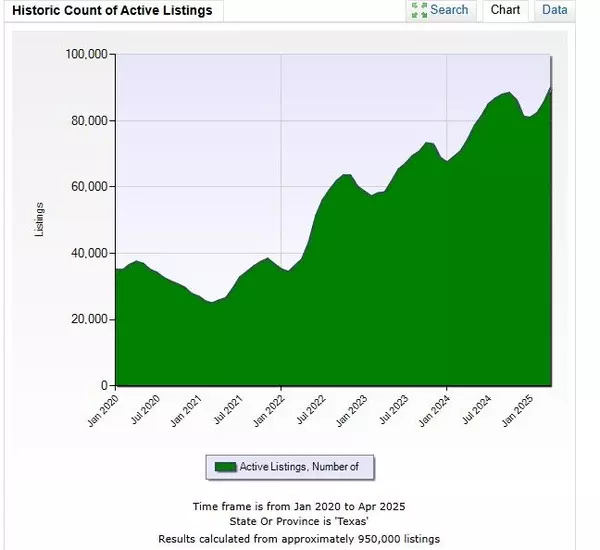

As home values in Aubrey stabilize or decline slightly due to higher interest rates, short sales are making a comeback.

3. Rent the Property Out

If you're able to cover your mortgage (or most of it) with rental income, leasing your home might buy you time until the market recovers. Aubrey’s growing population and proximity to the 380 corridor make it attractive for renters, especially those priced out of neighboring Frisco or Prosper.

4. Deed in Lieu of Foreclosure

In this scenario, you voluntarily transfer the property back to your lender to avoid foreclosure proceedings. It’s faster and cleaner than foreclosure and may come with relocation assistance. However, it still requires lender approval and proof that you’ve exhausted other options.

5. Sell with an Experienced Local Agent

A creative, seasoned real estate professional in Aubrey, TX may uncover solutions that aren't obvious. From negotiating with banks to tapping into investor networks, a knowledgeable agent can make a difference.

We can offer free property evaluations, connect you to short sale negotiators, or assist with off-market investor sales that help you move forward without the black mark of foreclosure.

Don’t Wait Too Long

The worst thing you can do is nothing. If you're behind on payments or worried about home values, act early. Foreclosure can often be avoided—especially in a market like Aubrey where buyers still exist, but need the right price and strategy.

Need Help?

Contact Justin Henry Real Estate Advisors, your local experts in distressed property solutions. We’ll help you understand your best options—with no pressure.

📞 Call today for a confidential consultation.

972-757-6273

Categories

- All Blogs (28)

- 5 things before winter (1)

- aubrey (4)

- aubrey homes (4)

- Builder (1)

- buy (3)

- buying (6)

- Dallas (10)

- discount homes (1)

- equity (4)

- home buying (2)

- Home Sales (10)

- homes (8)

- homes in aubrey (2)

- homes with pools (2)

- inventory (1)

- leasing (2)

- little elm homes (3)

- multiple offers (2)

- Painting The Room, Should you paint, painting before selling, selling your home in little elm, get your home painted (1)

- pool house (2)

- price (7)

- real estate negotiations, (2)

- Staging (4)

- taxes (3)

- Window Coverings, energy efficeint windows (1)

- winter (2)

- winter in texas (2)

Recent Posts

26875 US Hwy 380 # 112, Aubrey, TX, 76227, United States